Explained in 90 seconds

Medtech & Services is an investment in 10% of global gross domestic product: Healthcare sector excluding drugs

Bottom line: above-average and steady growth compared to the broad market

Digitalization and the use of GenAI is boosting sales and earnings growth

Indexed performance (as at: 11.04.2025)

NAV: EUR 171.63 (10.04.2025)

Rolling performance (11.04.2025)

| T-EUR | MSCI World IMI HC Equip. & Supllies | MSCI World HC Net Return | |

| 10.04.2024 - 10.04.2025 | -5.14% | -4.16% | -8.89% |

| 10.04.2023 - 10.04.2024 | 11.25% | 8.55% | 7.27% |

| 10.04.2022 - 10.04.2023 | -11.02% | -12.04% | -4.78% |

| 10.04.2021 - 10.04.2022 | 16.09% | 11.42% | 30.74% |

Annualized performance (11.04.2025)

| T-EUR | MSCI World IMI HC Equip. & Supllies | MSCI World HC Net Return | |

| 1 year | -5.14% | -4.16% | -8.89% |

| 3 years | -2.08% | -2.92% | -2.37% |

| 5 years | 6.16% | 5.30% | 6.52% |

| 10 years | 7.96% | 8.83% | 5.34% |

| Since Inception p.a. | 7.95% | n.a. | n.a. |

Cumulative performance (11.04.2025)

| T-EUR | MSCI World IMI HC Equip. & Supllies | MSCI World HC Net Return | |

| 1M | -8.81% | -10.09% | -12.23% |

| YTD | -9.91% | -10.51% | -10.18% |

| 1 year | -5.14% | -4.16% | -8.89% |

| 3 years | -6.11% | -8.50% | -6.93% |

| 5 years | 34.87% | 29.44% | 37.17% |

| 10 years | 115.02% | 133.15% | 68.16% |

| Since Inception | 675.49% | n.a. | n.a. |

Annual performance

| T-EUR | MSCI World IMI HC Equip. & Supllies | MSCI World HC Net Return | |

| 2024 | 15.73% | 15.30% | 8.12% |

| 2023 | 1.30% | 5.08% | 0.45% |

| 2022 | -11.61% | -19.83% | 0.55% |

| 2021 | 25.32% | 23.65% | 28.63% |

Facts & Key figures

Investment Focus

The fund’s aim is to achieve capital growth in the long term, is actively managed and invests worldwide in companies active in the medical technology and healthcare services sector. Show moreShow less

Investment suitability & Risk

Low risk

High risk

General Information

| Investment Manager | Bellevue Asset Management AG |

| Custodian | CACEIS BANK, LUXEMBOURG BRANCH |

| Fund Administrator | CACEIS BANK, LUXEMBOURG BRANCH |

| Auditor | PriceWaterhouseCoopers |

| Launch date | 28.09.2009 |

| Year end closing | 30. Jun |

| NAV Calculation | Daily "Forward Pricing" |

| Cut of time | 15:00 CET |

| Management Fee | 1.20% |

| Subscription Fee (max.) | 5.00% |

| ISIN number | LU0433846515 |

| Valor number | 10264395 |

| Bloomberg | BFLBBTE LX |

| WKN | A0RP27 |

Legal Information

| Legal form | Luxembourg UCITS V SICAV |

| SFDR category | Article 8 |

Key data (31.03.2025, base currency EUR)

| Beta | 0.98 |

| Volatility | 17.26 |

| Tracking error | 6.43 |

| Active share | 22.36 |

| Correlation | 0.93 |

| Sharpe ratio | 0.08 |

| Information ratio | 0.13 |

| Jensen's alpha | 0.86 |

| No. of positions | 45 |

Portfolio

Top 10 positions

Market capitalization

Geographic breakdown

Breakdown by sector

Benefits & Risks

Benefits

- Digitalization of the healthcare sector is boosting medtech companies’ growth and earnings.

- Focusing on profitable, liquid mid and large cap companies with an established product portfolio as well as on rapidly growing small cap businesses delivering cutting-edge technology.

- Managed care profits from the privatization of the health insurance sector and lower treatment costs.

- Minimally invasive techniques gaining ground – shorter treatment times reduce healthcare costs.

- Bellevue – Healthcare pioneer since 1993 and today one of the biggest independent investors in the sector in Europe.

Risks

- The fund actively invests in equities. Equities are subject to price fluctuations and so are also exposed to the risk of price losses.

- The fund invests in foreign currencies, which means a corresponding degree of currency risk against the reference currency.

- The fund may invest a proportion of its assets in financial instruments that might under certain circumstances have a relatively low level of liquidity, which can in turn affect the fund’s liquidity.

- Investing in emerging markets entails the additional risk of political and social instability.

- The fund may engage in derivatives transactions. The increased opportunities gained come with an increased risk of losses.

Review / Outlook

The medtech sector (MSCI World Healthcare Equipment & Supplies Net -8.1%) retreated in step with the global stock market, while the Bellevue Medtech & Services Fund (-7.9%) fared a bit better than its benchmark.

European equity markets (Dax -1.7%, Euro Stoxx 50 -3.8%) benefited from Germany’s defense and infrastructure investment plans and the easing of its constitutional borrowing limits. Meanwhile the euro appreciated significantly against the dollar, gaining 4.3% vs the USD over the month. This additional negative currency translation effect is clearly visible when viewing the performance of the medtech sector (-4.5%) and the Bellevue Medtech & Services Fund (-4.3%) in USD.

In the healthcare services space, HCA Healthcare (+8.7%), the largest hospital chain in the US, and US health insurers UnitedHealth (+6.5%), Elevance (+5.8%), Molina (+5.2%) and Cigna (+2.9%) made positive contributions to performance. All of these services providers generate all of their profits in the US and are therefore not affected in any negative way by Trump's tariffs.

HCA management also said that the course of business during the first quarter had been very positive.

Health insurers’ strong performance in March was fueled by two factors. On the one hand investors began to take an increasingly positive view of the government's 2026 Medicare Advantage payment policy update. Medicare Advantage also enjoys strong support from Republicans. On top of that, Elevance and Centene executives mentioned at an investor conference that analysts’ estimates of their first-quarter earnings are too low. Their remarks also had a positive impact on the stock prices of other health insurers.

In the medtech space, Zimmer Biomet (+4.5%) and Terumo (+1.8%) made positive contributions to portfolio performance. At this year’s American Academy of Orthopedic Surgeons (AAOS) conference, Zimmer Biomet presented seven new products that are expected to increase the company’s weighted average market growth rate from around 4% to 5% by 2027.

Large-cap medtech companies such as Intuitive Surgical (-16.9%), Abbott (-7.6%), EssilorLuxottica (-7.5%), Stryker (-7.1%) and Boston Scientific (-6.5%) weighed on the fund’s performance. These stocks were sold off on worries that the Trump administration would introduce new tariffs in early April, worries that triggered particularly heavy selling in Intuitive Surgical. Those worries were compounded by fears that cutbacks in federal funding for Medicaid would reduce patient demand at hospitals and have a negative impact on medical device manufacturers. We believe the US government has little interest in making things harder for the country’s poorest households.

Shares of life science tools companies Thermo Fisher (-9.5%) and Danaher (-5.0%) also declined on investor worries about new tariffs.

All performance data is in EUR / B shares.

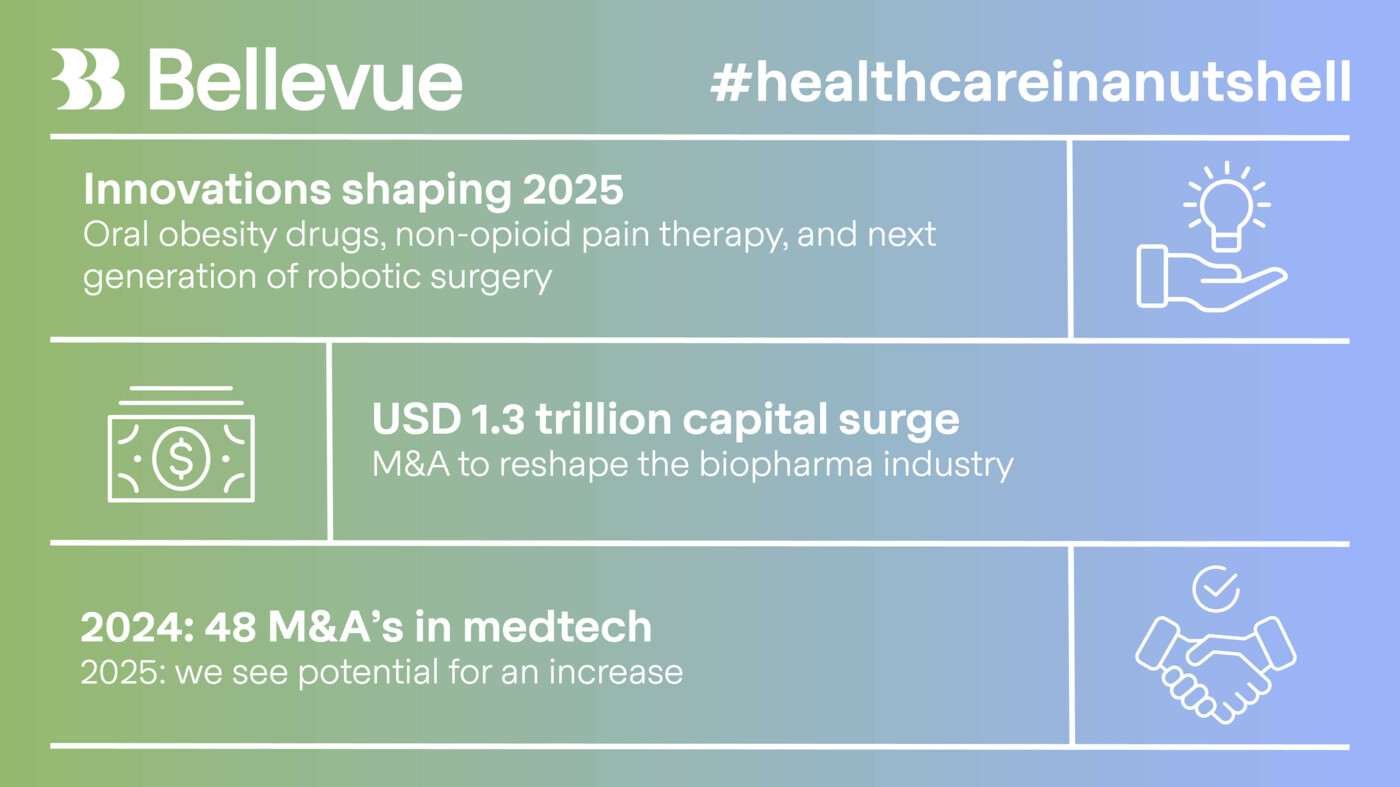

The approval and subsequent launch of relevant new products will continue to bolster sales growth, too. Examples here are Abbott’s Lingo, Libre Rio, Libre 3, TriClip and AVEIR products, Boston Scientific’s Farapulse PFA system and Watchman FLX Pro device, and the new da Vinci 5 surgical robot from Intuitive Surgical. We expect sector pricing power to remain above historical levels in 2025, too. Margins should continue to widen thanks to the above-average sales growth and a wave of new product launches with high margins.

In the healthcare services space, we believe hospital operators, healthcare technology companies and US health insurers have considerable upside potential. Hospitals should benefit from high patient volumes, higher prices, and only moderately higher personnel costs. We expect health insurers to report solid member growth and significantly higher profit margins in Medicare Advantage and Medicaid business lines. Continued high US Treasury yields could also have an accretive effect on earnings.

Furthermore, there are already signs that M&A activity is gaining momentum after the appointment of a business-friendly director for the US antitrust authority and large-cap companies are clearly ready to use their strong balance sheets to drive external growth. Today's attractive valuation levels are enticing too. The anticipated large-scale shift of investor assets out of stocks that had made strong gains during the previous year is another factor that favors the Bellevue Medtech & Services (Lux) Fund.

Documents

Show moreShow less