New blockbuster markets in the medtech sector

The latest surgical robot system also a platform for AI applications

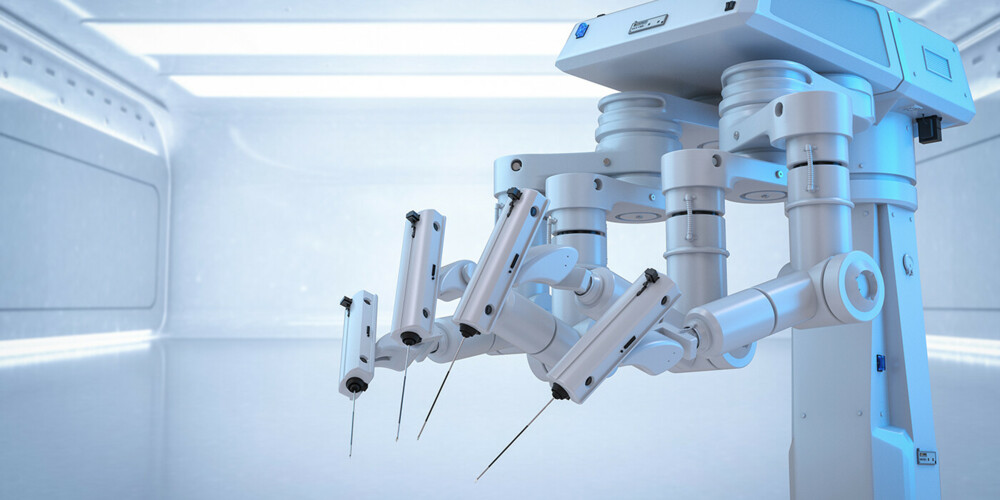

The latest generation of the da Vinci 5 (dV5) surgical robot from Intuitive Surgical has 10,000 times more computing power than its predecessor, which will enable the launch of new AI-based applications. AI capability could soon make robot-assisted surgery standard practice in the operating room. New, advanced sensors allow the dV5 to simulate haptic feedback, which helps surgeons to perform with greater confidence and accuracy. During an operation, data is collected through sensors and images that can then be used for objective performance feedback or to create individual training plans. In the long term, this data could conceivably enable complex AI applications that, for example, recognize different types of tissue or offer surgeons recommendations during surgery. Hardware upgrades include AR glasses for image transmission and the integration of an insufflator. These enhancements improve surgical precision and reduce operation time.

Intuitive Surgical will continue to market its predecessor system da Vinci Xi, enabling them to establish different price segments for surgical robots in the process. The dV5 was launched in the US in the first quarter of 2024 and will be launched in other countries during the course of 2025. Intuitive Surgical offers its customers flexible leasing agreements that allow them to upgrade from an older to a newer generation product, so the roll-out of dV5 should not result in a temporary dip in growth for Intuitive Surgical. Xi systems returned by customers upgrading to dV5 can be placed in more price-sensitive markets, which will expand Intuitive Surgical’s installed base and thus strengthen the main sales engine of its business, which is selling robotic instruments and accessories. The dV5 is expected to lead to an acceleration in sales growth, higher unit selling prices, and better profit margins. At the same time, Intuitive Surgical’s launch of its next-generation surgical robot extends its lead over competitors such as Medtronic and Johnson & Johnson. The market potential is huge: In the US alone, 3.8 million general surgery procedures, 3.3 million cardiothoracic procedures, and 2.5 million urology and gynecology procedures are performed every year. We estimate that the surgical robots market for soft tissue surgery will double in size from USD 7.5 bn in 2024 to approximately USD 15 bn in 2028.

Continuous glucose monitors: A USD 20 billion market thanks to new products from Abbott and Dexcom

Completely new customer target groups have emerged in the field of diabetes. Dexcom, for example, recently brought Stelo, a glucose biosensor approved by the FDA in March, to the market. This sensor is designed for people with diabetes who do not use insulin to better understand how diet and exercise may impact blood sugar levels. Abbott followed suit in June when the FDA approved its Lingo biosensor. Both sensors can be bought over the counter, i.e., without a prescription. We expect the global market volume for continuous glucose monitoring systems in 2028 to be well above USD 20 bn (2023: USD 10 bn) and that Abbott and Dexcom will have a combined market share of about 90%. Insulin pump manufacturers such as Insulet could also benefit from the rapid growth of glucose biosensors. This is because at some point in the future, most people with type 1 diabetes will be wearing a biosensor, making it easier for them to transition to a fully integrated insulin delivery system, i.e., there will be less need for information and education on how to use the new product.

New procedure for cardiac arrhythmias with high growth potential

Structural heart disease, especially faulty heart valves, is also a major growth driver in the medical technology market. Minimally invasive surgical procedures are already standard for aortic heart valve replacement. The global market volume for transcatheter aortic valve replacement is forecast to reach USD 10 bn in 2028. The recent US approval of Evoque from Edwards Lifesciences, the world’s first transcatheter tricuspid valve replacement system, has opened up an entirely new market whose long-term potential is comparable to that of aortic valves. Mitral valve surgery, which is currently dominated by repair procedures such as the MitraClip (Abbott) or the Pascal Precision system (Edwards Lifesciences), is another area where an alternative solution could soon be cleared for marketing. Breakthrough data from Edwards Lifesciences’ trial of its M3 transcatheter mitral valve replacement system is expected in early 2025.

Treatment options for cardiac arrhythmia, atrial fibrillation in particular, have been enhanced with the emergence of a new non-thermal ablation procedure known as pulsed field ablation (PFA). This innovative technology is likely to supplant conventional cryoablation (extremely cold temperatures) or radiofrequency ablation (heat) procedures because it is safer and faster. Thanks to the advantages of PFA, market volume could grow from currently zero to USD 6 bn in 2028. Boston Scientific and Medtronic are both marketing PFA products backed by excellent clinical trial data. Two other industry heavyweights, Johnson & Johnson and Abbott, are about to enter the market with new products of their own.

Tailwinds for investors

These developments illustrate the impressive range of groundbreaking innovation typical of the medtech sector, along with the attractive investment opportunities that it offers. The Bellevue Medtech & Services Fund (ISIN B-EUR LU0415391431) invests in precisely these high-growth areas through a portfolio of 40 to 60 stocks with a high 90% large-cap weighting that enhances portfolio stability.