Medical technology back on track

World and European stock markets continued to trade higher in January. The broad healthcare sector and the medical technology sector, buoyed by resurgent investor interest, delivered even better returns. The fundamental factors associated with the healthcare industry are appealing given the current macroeconomic environment. Not only that, the medtech markets are showing very pleasing growth rates. This can be traced on the one hand to the many new or just recently launched medtech products in the market with blockbuster potential and, on the other hand, to the backlog of surgical procedures that accumulated during the coronavirus pandemic, which – as predicted last year by Stefan Blum and Marcel Fritsch – will generate additional volume in 2024 and thus lead to a strong acceleration in overall growth for medtech companies. “We also anticipate a big boost in growth from the increasing use of artificial intelligence in the medical technology and healthcare services industries,” Stefan Blum adds. “The deployment of generative AI (GenAI) is spurring digitalization processes in medtech and healthcare services, resulting in better treatments and lowering administrative expense by up to 25%. These developments are likely to trigger a new wave of innovation.”

Positive earnings expectations at medtech companies

The encouraging discussions the two portfolio managers had with many executives from companies attending the J.P. Morgan Healthcare Conference in San Francisco also bolster their confidence for 2024. “Senior executives of major healthcare companies are at this conference and many of them gave an initial assessment of sales and earnings for the final quarter of 2023. These were generally characterized by strong growth momentum in surgical procedures and an optimistic outlook for the 2024 fiscal year,” Marcel Fritsch comments.

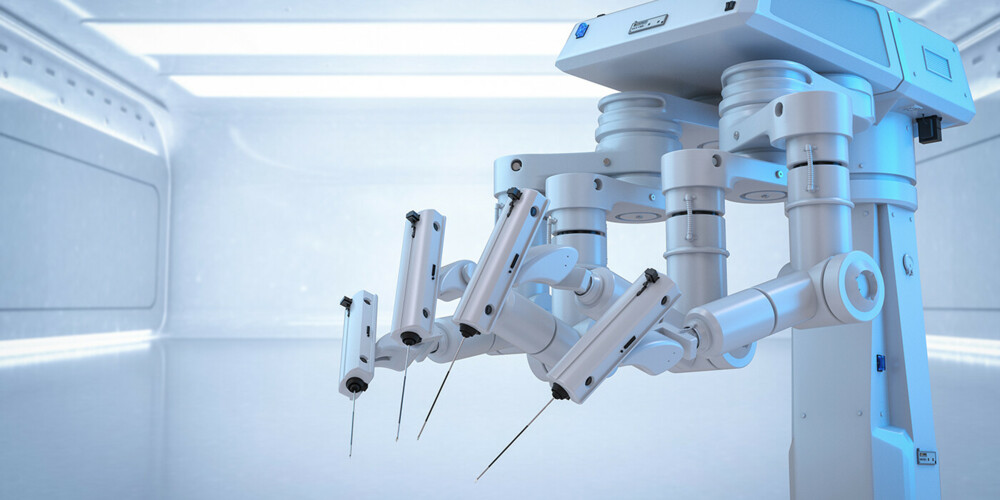

From this angle, the strong performance in January by large-cap stocks such as Intuitive Surgical, Stryker, Boston Scientific, Medtronic, and Abbott does not come as a surprise. Intuitive Surgical pleased investors when it published fast growth rates for both robotic procedure volumes and new system sales and, especially, by announcing the da Vinci 5, its next-generation surgical robot. Mid- and small-cap medtech names such as Shockwave, Procept BioRobotics, Axonics and TransMedics also had a strong start to the year. Axonics received a takeover bid from Boston Scientific, which points to the clearly faster pace of M&A in the healthcare sector today.

Mostly positive picture for healthcare services

The general picture for healthcare services providers was also positive. HCA Healthcare, the largest hospital chain in the US, exceeded expectations by reporting higher procedure volumes, higher prices, and lower personnel costs.

Most US health insurance stocks traded higher. Elevance, which is focused on employer-sponsored health insurance plans, reported better-than-expected profits thanks to a drop in medical costs and an increase in management’s earnings guidance for 2024. Centene and Cigna confirmed their earnings guidance at the J.P. Morgan Healthcare Conference. Humana, an insurer focused on Medicare Advantage plans for people older than 65, disappointed investors with its latest quarterly report and the earnings outlook it issued for 2024. Humana said demand for medical services and patient care in late 2023 was higher than anticipated and that its premium rates for 2024 had therefore been set too low. The two portfolio managers assume that this is a temporary, company-specific problem.

Tailwind in 2024 powered by several factors

From a fundamental standpoint, medtech companies, hospital operators and health insurers have been on a stable, above-average growth trajectory since the summer of 2023 and this growth should continue in 2024.

Stefan Blum: “In the ongoing fourth-quarter reporting season, many medtech companies have published better-than-average quarterly results and many expect strong surgical procedure growth in 2024. The approval and subsequent launch of relevant new products will continue to bolster sales growth, too. Abbott’s TriClip, AVEIR and Libre products, Boston Scientific’s Farapulse PFA system and the next-generation da Vinci 5 surgical robot from Intuitive Surgical are but a few examples of products nearing market launch. We believe the sector's pricing power will remain intact, enabling price markups in the low single-digit percentage range. Margins are expected to increase thanks to the above-average sales growth and to further improvements in supply chains.”

As for healthcare services providers, Marcel Fritsch remarked: “In the healthcare services space, we see substantial upside potential for US hospitals and health insurers. Hospitals will benefit from high patient volumes, higher prices, and only moderately higher labor costs. We expect health insurers to report rising premium income in the wake of solid membership growth and premium rate increases. Persisting high US government bond yields could have an accretive effect on earnings, too. Political risks are still low. We believe neither party will win a solid majority of seats in either chamber of Congress in the November elections.”

Bellevue Medtech & Services should enjoy strong tailwinds in 2024. Numerous factors ranging from interest rate cuts in the US to attractive stock valuations will fuel these tailwinds. The fund should also benefit from widespread repositioning as investors sell last year's outperformers and buy higher-quality stocks instead. Moreover, in the past, meager growth prospects for the world economy have actually been a favorable backdrop for non-cyclical sectors such as healthcare.