Explained in 90 seconds

Healthcare systems will benefit from the huge pools of data that have been built up over decades

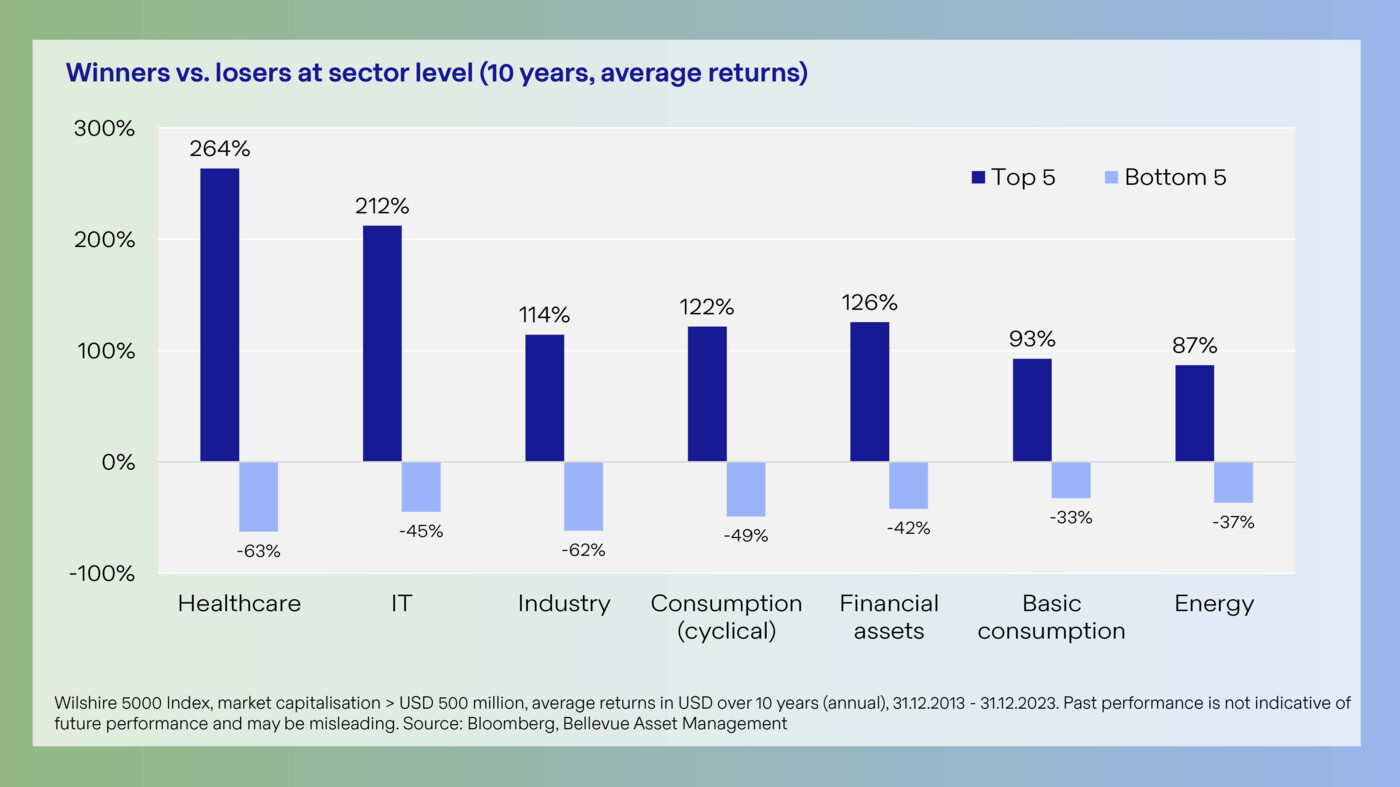

GenAI will be a relevant driver of shareholder value

Sweet spot: Well-capitalized companies with strong AI capabilities

Indexed performance (as at: 17.04.2025)

NAV: CHF 120.85 (16.04.2025)

Rolling performance (17.04.2025)

| B-CHF | Benchmark | |

| 16.04.2024 - 16.04.2025 | -12.77% | -11.46% |

Cumulative performance (17.04.2025)

| B-CHF | Benchmark | |

| 1M | n.a. | n.a. |

| YTD | n.a. | n.a. |

| 1 year | n.a. | n.a. |

| Since Inception | n.a. | n.a. |

Annual performance

| B-CHF | Benchmark | |

| 2024 | 9.82% | 9.40% |

Facts & Key figures

Investment Focus

The fund’s aim is to achieve capital growth in the long term. The Bellevue AI Health Fund is a global equity fund with an actively managed portfolio of 50 to 70 stocks, mostly from the healthcare sector, rounded out with a small number of tech companies that have considerable exposure to the healthcare industry. Show moreShow less

Investment suitability & Risk

Low risk

High risk

General Information

| Investment Manager | Bellevue Asset Management AG |

| Custodian | CACEIS BANK, LUXEMBOURG BRANCH |

| Fund Administrator | CACEIS BANK, LUXEMBOURG BRANCH |

| Auditor | PriceWaterhouseCoopers |

| Launch date | 30.11.2023 |

| Year end closing | 30. Jun |

| NAV Calculation | Daily "Forward Pricing" |

| Cut of time | 15:00 CET |

| Management Fee | 1.60% |

| Subscription Fee (max.) | 5.00% |

| ISIN number | LU2721086259 |

| Valor number | 130851892 |

| Bloomberg | BAIHXBC LX |

| WKN | A3E1ZS |

Legal Information

| Legal form | Luxembourg UCITS V SICAV |

| SFDR category | Article 8 |

Key data (31.03.2025, base currency USD)

| Beta | 0.99 |

| Volatility | 10.86 |

| Tracking error | 3.04 |

| Active share | 20.93 |

| Correlation | 0.96 |

| Sharpe ratio | -0.59 |

| Information ratio | -0.46 |

| Jensen's alpha | -1.43 |

| No. of positions | 69 |

Portfolio

Top 10 positions

Geographic breakdown

Benefits & Risks

Benefits

- GenAI is speeding up the process of digitization and automation across the healthcare system.

- GenAI can enhance patient care, simplify processes and procedures, and lead to better decisions.

- Companies that use or provide GenAI tools for healthcare-relevant purposes will gain a sustainable competitive advantage.

- Shareholder value creation will largely be determined by a company’s AI strategy and its execution.

- Bellevue – a pioneer in healthcare investing since 1993 and now one of the largest independent investors in the healthcare space in Europe.

Risks

- The fund actively invests in equities. Stocks are subject to price fluctuations, so there is a risk of falling prices.

- The investments the fund makes may be denominated in foreign currency, which can entail a foreign-exchange risk relative to the fund's base currency.

- The fund may invest some of its assets in financial instruments that may have relatively low levels of liquidity under certain circumstances, which may then affect the liquidity of the fund’s own shares.

- There are additional risks in the form of political and social unrest when investing in emerging markets.

- The fund may use derivatives. Derivatives offer greater upside potential yet also carry greater downside risk.

Review / Outlook

Against this backdrop large-cap indexes such as the MSCI World (-4.5%), the S&P 500 (-5.6%) and the Nasdaq 100 (-7.6%) closed the month deep in the red. The broad healthcare sector (-2.3%) was not completely shielded from the sell-off but, as one could expect, it gave up less ground than the broader market because of its defensive profile. The same applies to the Bellevue AI Health Fund (-3.3%), although it lagged slightly behind its benchmark.

Biopharma (53.6% weighting at the end of the month) contributed a negative -2.1% to absolute performance and -0.1% to relative performance. Positive contributors to performance in this segment were Alnylam (+9.4%), Novartis (+5.9%) and Roche (+2.3%), while Novo Nordisk (-23.0%), Eli Lilly (-10.3%) and Regeneron (-9.2%) made negative contributions to performance. Roche signed a collaboration agreement with Danish biotech company Zealand Pharma under which it will pay up to USD 5.3 bn to co-develop and co-commercialize petrelintide as a therapy for people with obesity. Petrelintide’s active ingredient is based on the peptide hormone amylin and initial data suggests it is about as effective as GLP-1 receptor agonists but with a significantly better side effect profile. News of Roche's partnership with Zealand led to the sell-off in Novo Nordisk and Eli Lilly, both market leaders in GLP-1 therapies. Reported prescription volumes for weight-loss drugs recently fell short of investor expectations, which likewise weighed on their share prices. The latest readout from a Phase III trial of Novo Nordisk's next-generation obesity drug CagriSema did not show significantly better efficacy than Eli Lilly's Zepbound (tirzepatide) after 68 weeks of treatment either.

Medtech stocks (28.8%) had a negative impact of -1.6% on absolute performance and -0.4% on relative performance. Kestra Medical (+46.6%) and Terumo (+5.8%) were performance drivers in this space, while Beta Bionics (-41.6%), Dexcom (-22.7%), Intuitive Surgical (-13.6%) and Thermo Fisher (-5.9%) detracted. Kestra Medical, a company that went public in March in a transaction that we successfully participated in, has developed and launched an AI-enhanced wearable cardioverter defibrillator system called Assure. Cardioverter defibrillator systems help protect patients at high risk of sudden cardiovascular death. Nearly all the instruments used with Intuitive Surgical’s da Vinci robotic surgical systems are manufactured in Mexico, so any US import tariffs would add to the cost of these products. However, Intuitive Surgical’s pricing model could offset part of the extra tariff-related costs.

The absolute and relative performance contributions of healthcare services providers (11.7%) were +0.9% and -0.2% respectively. UnitedHealth (+10.8%) and Elevance (+10.1%) made positive contributions to performance. All of the profits of these two US health insurers are generated in the US and are therefore shielded from Trump’s tariffs. Elevance management also mentioned at a recent conference for investors that current consensus estimates for its first-quarter earnings were too low.

The fund's tech exposure (4.4%), which includes tech names from both the healthcare and IT industries, had a negative impact of -0.4% on both absolute and relative performance. Veeva Systems (+3.3%) made a positive performance contribution after reporting 4Q sales and earnings for the fiscal year ended January 31 that exceeded consensus estimates by a wide margin. Investors marked down Oracle (-15.8%), Waystar (-14.1%) and Nvidia (-13.2%) on fears that a slowdown in US economic activity would hamper their future sales growth.

All performance data in USD / B shares.

GenAI is creating tremendous opportunities for businesses and investors, especially in the health sector. According to a number of studies, the health sector will be one of the industries that will benefit the most from the deployment of GenAI. This forecast is mainly based on the considerable potential for efficiency gains in healthcare systems, on the large, readily available amounts of data in healthcare systems, and on the considerable financial resources available for healthcare needs.

Already today medications are being developed more quickly and with better rates of success, for example, new diagnostic and treatment methods are producing better clinical outcomes, and GenAI is helping medical professionals make better and more informed decisions.

We focus on healthcare companies that have made GenAI a core element of their business strategy and that are investing substantial resources in this technology to gain a lasting competitive advantage and achieve superior value growth. The technology risk here is more calculable than in other industries because healthcare is such a heavily regulated industry.

Documents

Show moreShow less