Explained in 90 seconds

Medtech & Services is an investment in 10% of global gross domestic product: Healthcare sector excluding drugs

Bottom line: above-average and steady growth compared to the broad market

Digitalization and the use of GenAI is boosting sales and earnings growth

Indexed performance (as at: 11.03.2025)

NAV: GBP 623.03 (10.03.2025)

Rolling performance (11.03.2025)

| I-GBP | MSCI World IMI HC Equip. & Supllies | MSCI World HC Net Return | |

| 10.03.2024 - 10.03.2025 | 2.08% | 3.31% | 0.91% |

| 10.03.2023 - 10.03.2024 | 15.06% | 13.14% | 11.53% |

| 10.03.2022 - 10.03.2023 | -3.30% | -5.61% | 5.33% |

| 10.03.2021 - 10.03.2022 | 9.79% | 5.51% | 17.61% |

Annualized performance (11.03.2025)

| I-GBP | MSCI World IMI HC Equip. & Supllies | MSCI World HC Net Return | |

| 1 year | 2.08% | 3.31% | 0.91% |

| 3 years | 4.34% | 3.33% | 5.83% |

| 5 years | 8.11% | 7.63% | 9.26% |

| 10 years | 11.65% | 12.41% | n.a. |

| Since Inception p.a. | 13.20% | 14.26% | n.a. |

Cumulative performance (11.03.2025)

| I-GBP | MSCI World IMI HC Equip. & Supllies | MSCI World HC Net Return | |

| 1M | -8.91% | -8.42% | -2.81% |

| YTD | 0.41% | 1.10% | 4.10% |

| 1 year | 2.08% | 3.31% | 0.91% |

| 3 years | 13.58% | 10.34% | 18.53% |

| 5 years | 47.68% | 44.45% | 55.72% |

| 10 years | 201.01% | 222.07% | n.a. |

| Since Inception | 398.42% | 462.09% | n.a. |

Annual performance

| I-GBP | MSCI World IMI HC Equip. & Supllies | MSCI World HC Net Return | |

| 2024 | 10.76% | 10.02% | 3.10% |

| 2023 | -0.77% | 2.63% | -1.65% |

| 2022 | -6.31% | -15.28% | 5.82% |

| 2021 | 17.90% | 15.99% | 20.83% |

Facts & Key figures

Investment Focus

The fund’s aim is to achieve capital growth in the long term, is actively managed and invests worldwide in companies active in the medical technology and healthcare services sector. Show moreShow less

Investment suitability & Risk

Low risk

High risk

General Information

| Investment Manager | Bellevue Asset Management AG |

| Custodian | CACEIS BANK, LUXEMBOURG BRANCH |

| Fund Administrator | CACEIS BANK, LUXEMBOURG BRANCH |

| Auditor | PriceWaterhouseCoopers |

| Launch date | 28.09.2009 |

| Year end closing | 30. Jun |

| NAV Calculation | Daily "Forward Pricing" |

| Cut of time | 15:00 CET |

| Management Fee | 0.90% |

| Subscription Fee (max.) | 5.00% |

| ISIN number | LU0767969719 |

| Valor number | 18316252 |

| Bloomberg | BFLBBIG LX |

| WKN | A1JWD9 |

Legal Information

| Legal form | Luxembourg UCITS V SICAV |

| SFDR category | Article 8 |

Key data (28.02.2025, base currency EUR)

| Beta | 0.98 |

| Volatility | 17.47 |

| Tracking error | 6.48 |

| Active share | 22.16 |

| Correlation | 0.93 |

| Sharpe ratio | 0.28 |

| Information ratio | 0.10 |

| Jensen's alpha | 0.78 |

| No. of positions | 45 |

Portfolio

Top 10 positions

Market capitalization

Geographic breakdown

Breakdown by sector

Benefits & Risks

Benefits

- Digitalization of the healthcare sector is boosting medtech companies’ growth and earnings.

- Focusing on profitable, liquid mid and large cap companies with an established product portfolio as well as on rapidly growing small cap businesses delivering cutting-edge technology.

- Managed care profits from the privatization of the health insurance sector and lower treatment costs.

- Minimally invasive techniques gaining ground – shorter treatment times reduce healthcare costs.

- Bellevue – Healthcare pioneer since 1993 and today one of the biggest independent investors in the sector in Europe.

Risks

- The fund actively invests in equities. Equities are subject to price fluctuations and so are also exposed to the risk of price losses.

- The fund invests in foreign currencies, which means a corresponding degree of currency risk against the reference currency.

- The fund may invest a proportion of its assets in financial instruments that might under certain circumstances have a relatively low level of liquidity, which can in turn affect the fund’s liquidity.

- Investing in emerging markets entails the additional risk of political and social instability.

- The fund may engage in derivatives transactions. The increased opportunities gained come with an increased risk of losses.

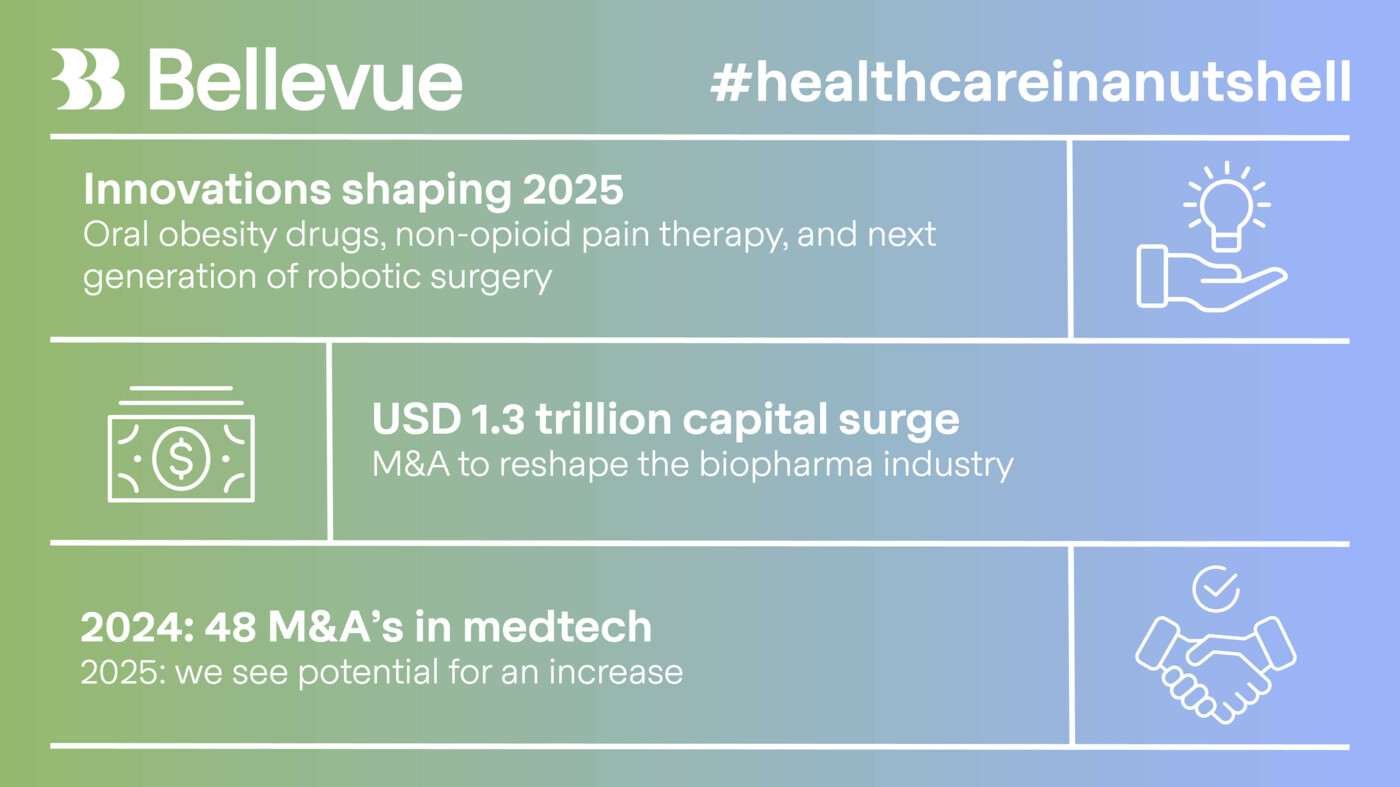

Review / Outlook

The latest news on the US economy (weak jobs data and falling consumer confidence) and Donald Trump’s threats to impose tariffs on imported goods from China, Canada and Mexico slowed Wall Street's previously strong run. We observed capital flows into defensive stocks and some signs of profit-taking. The sector rotation triggered in January by the Chinese company DeepSeek continued into February on news of its pending R2 AI model launch, as investors shifted more money flowed out of tech stocks and into healthcare (MSCI World Healthcare Net +1.3%) and other sectors. After their strong showing in January (+8.7%), the medtech sector (MSCI World Healthcare Equipment & Supplies Net -0.9%) and the Bellevue Medtech & Services Fund (-1.1%) performed in line with the world stock market in February. Bond yields drifted lower over the month, with 10-year US Treasurys falling 0.3% to 4.2%, a pleasing trend that should give equity valuations prolonged support, especially in high-growth sectors such as medical technology.

We already covered the issue of import tariffs in detail in our previous monthly fund reviews. Our position here was confirmed in our talks with company executives in February, namely that medtech companies 1) were not very vulnerable to tariffs, 2) could again expect tariff exemptions for their products, and 3) have a very similar production footprint, so any new tariffs would not necessarily change the competitive landscape because if new tariffs are indeed imposed, the likely general industry response will be to pass all additional costs through to the customer.

Abbott (+8.1%), EssilorLuxottica (+8.0%), Penumbra (+7.2%) and Boston Scientific (+1.6%) made positive contributions to performance like in the previous month. Boston Scientific met high investor expectations, while Penumbra and Idexx (+3.8%) reported better-than-expected quarterly results. Align Technology (-14.5%), Becton Dickinson (-8.7%), Cooper (-6.2%) and Stryker (-1.1%) detracted from portfolio performance. Becton Dickinson’s quarterly results disappointed investors and the company also announced that it was planning to separate its biosciences and diagnostic solutions unit through a spin-off or other transaction, which is likely to weaken its earnings per share. In addition, the separation process will take some time and could lead to unexpected fluctuations in reported 2025 results. Align met investor expectations but currency translation had a highly negative impact.

Our decision to keep the portfolio weighting of healthcare services very low despite very enticing valuations proved to be a wise one in the month under review. Humana (-7.6%) and UnitedHealth (-12.3%) traded lower after the Wall Street Journal published an article claiming that the US Justice Department was launching a new investigation into their Medicare Advantage billing practices. UnitedHealth issued a media release in response stating that it was not aware of any new investigations and that the company's billing practices were reviewed by the government on a regular basis. It also stated that the Department of Justice regularly conducts such reviews and has never found any evidence of misconduct at UnitedHealth. All performance data is in EUR / B shares.

In the healthcare services space, we believe hospital operators, health tech companies and US health insurers have considerable upside potential. Hospitals should benefit from high patient volumes, higher prices, and only moderately higher personnel costs. We expect health insurers to report solid member growth and significantly higher profit margins in Medicare Advantage and Medicaid business lines. Continued high US Treasury yields could also have an accretive effect on earnings. Of greater importance for the performance of healthcare services stocks is whether the current cloud of uncertainty hanging over the industry will lift and more clarity about the long-term framework conditions will emerge after Donald Trump’s inauguration.

Meanwhile, there are already signs of a significant increase in M&A activity after the appointment of a business-friendly director for the US antitrust authority and that the large-cap companies will use their strong balance sheets to drive external growth. The currently attractive valuation levels are enticing from this angle too. The anticipated repositioning of investor assets out of stocks that made strong gains last year is yet another factor in favor of investing in the Bellevue Medtech & Services (Lux) fund.

Documents

Show moreShow less