Infrastructure investment comeback – a mega trend over the next decade and which companies stand to benefit from it

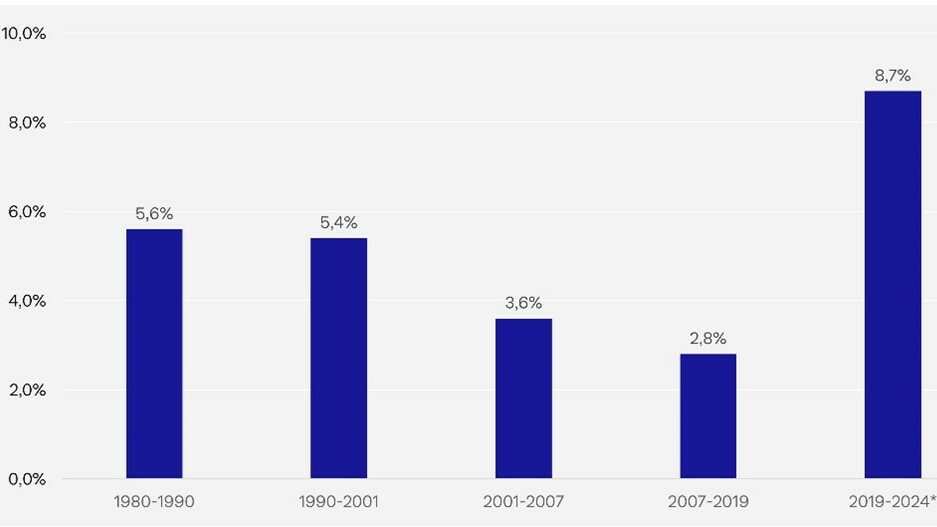

Business fixed investment had been on a steady downward trend for the past few decades, especially in Europe and the US. Whereas capital expenditures by industrial companies in the US had increased by more than 5% p.a. from 1980 to 2001, annual capex growth slowed to less than 3% during the subsequent two decades. There was even a period of extreme underinvestment in many industries in the aftermath of the 2007/08 financial crisis, a situation that is now being corrected. Fixed capital investment for the period from 2019 to 2024 has been forecast to increase at an unusually high rate of 8.7% per year.

A new mega trend

In the wake of the massive federal investment agenda in the US, a new mega trend is now under way. The Inflation Reduction Act (IRA) that was signed into law in August 2022 will be a major driver of this mega trend. Over the next ten years, approximately USD 300 bn will be spent on deficit-reducing measures and USD 369 bn will be invested in energy security and climate change mitigation projects in the US. Then there's the CHIPS and Science Act of 2022, which includes more than USD 50 bn in federal funding to revitalize domestic semiconductor R&D and manufacturing activities in the US, and which is expected to unlock almost as much in related private-sector investment. In view of those numbers, we are probably still in an early stage of the capex cycle. According to financial market strategist and historian Russell Napier, we are on the cusp of a capital investment boom and a reindustrialization of Western economies.

Downward trend in US capital investment stopped?

Annual growth rate (CAGR) of US industry capital expenditures through different periods

Europe has reached a turning point too

Huge investment programs are also being launched in the EU – first and foremost, the European Green Deal and the European Chips Act. The vast Green Deal alone sets aside EUR 600 bn for projects designed to modernize the EU economy and make it more resource-efficient and competitive. Under the European Chips Act, the EU is investing more than EUR 43 bn to boost its competitiveness and resilience in semiconductor technologies and applications while reducing the Continent's strong dependence on Asian and Chinese suppliers. The deal is expected to stimulate a similar amount of private-sector investments over the long term. Additional billions of dollars are expected to be spent on the construction of new battery gigafactories. According to a McKinsey research report, the investment volumes in this area will double by 2025. That is necessary because, as early as 2030 according to one PwC report, almost every second car sold will be a battery-powered or electric car.

Investment opportunities

The dynamics and sheer scale of these developments offer investors a wide range of opportunities, also in Switzerland and across Europe. For us as fundamentally oriented stockpickers, the transformation of the global infrastructure landscape is a key factor in the positioning and management of Bellevue’s Entrepreneur Funds. In the Bellevue Entrepreneur Swiss Small & Mid Fund, up to 30% of the portfolio companies are direct or indirect beneficiaries of this long-term trend. These include VAT, Inficon, Belimo, LEM, Gurit and Huber + Suhner. Below are three exciting examples:

IoT: a vital technology for Industry 4.0

After decades of globalization, company managers now want to take back control over their supply and value chains and increase the resilience of their business operations. This reconfiguration can be traced, among other factors, to the emergence of new geopolitical risks, strategic and national interests, an increased awareness of sustainability issues, and the aftermath of the COVID-19 pandemic. A particularly important driver behind this movement has been the onward march of digitalization and ever-increasing automation, two processes that facilitate the relocation of production processes to higher-cost regions (a practice known as nearshoring and reshoring). The Internet of Things (IoT) plays a key role in this wide-scale trend. IoT enables companies to connect their production sites and systems into an integrated platform, making seamless communication and efficient monitoring and control possible. IoT connection density is constantly increasing in step with the steadily expanding number of IoT applications. And these IoT solutions are becoming more and more sophisticated. The Swiss company U-Blox, a leading provider of IoT products and services, is in an excellent position to benefit from this growing opportunity. The company’s top- and bottom-line potential is still underestimated by investors, so the stock has tremendous upside potential from a valuation perspective.

New winners thanks to the energy transformation

Energy security is another critical issue. The world needs more energy here and now to bolster energy security and energy supply independence and, from a longer-term perspective, to ensure a sustainable future. Burckhardt Compression's technologically advanced compressor solutions are indispensable for its customers active in the natural gas, solar photovoltaics, or hydrogen markets. Huge investments are being made worldwide to promote the energy transition. With a global market share of 40% to 50%, it is not surprising that Burckhardt reported a record order intake of CHF 1.3 bn in its latest fiscal year. Its growing hydrogen business offers particularly interesting opportunities. Increasing demand for hydrogen as a source of clean energy and the need for hydrogen liquefaction by means of compression for ease of transportation and storage translate into attractive growth opportunities for Burckhardt Compression. Global hydrogen production capacity is projected to increase 10-fold by 2030.

Logistics: an indispensable part of any organization

In every country where construction spending on new manufacturing facilities is increasing as a result of reshoring and nearshoring projects, new intralogistics capacity covering a company’s entire value chain are needed. These far-reaching shifts in business processes and material flows require sophisticated solutions, and leading intralogistics experts such as Interroll and Kardex stand to profit as a result. Both are niche players that help firms to automate their warehousing, provisioning, and material flow systems, something that has become increasingly important in terms of efficiency and cost. Growing demand in this field can be traced to a variety of factors, including government incentives to promote the domestic development of strategically relevant technology and the general need for more secure and efficient logistics operations.

Conclusions

We are witnessing a new capex boom in the West that is both strategic and political in nature. The ongoing global infrastructure investment cycle is a mega trend that will accompany us for at least the next ten years. Companies that – figuratively speaking – create and market “shovels” for this new gold rush in the form of innovative technology, must-have services and smart solutions – logistics specialists, energy infrastructure specialists, and IoT solution providers, for example – clearly stand to benefit.