Indexed performance (as at: 11.04.2025)

NAV: USD 116.05 (10.04.2025)

Rolling performance (11.04.2025)

| I-USD | Benchmark | |

| 10.04.2024 - 10.04.2025 | -6.47% | -4.97% |

| 10.04.2023 - 10.04.2024 | 5.92% | 6.16% |

| 10.04.2022 - 10.04.2023 | -8.41% | -4.99% |

Annualized performance (11.04.2025)

| I-USD | Benchmark | |

| 1 year | -6.47% | -4.97% |

| 3 years | -3.19% | -1.40% |

| Since Inception p.a. | -2.42% | -0.07% |

Cumulative performance (11.04.2025)

| I-USD | Benchmark | |

| 1M | -9.27% | -9.26% |

| YTD | -3.66% | -2.82% |

| 1 year | -6.47% | -4.97% |

| 3 years | -9.26% | -4.15% |

| Since Inception | -7.16% | -0.20% |

Annual performance

| I-USD | Benchmark | |

| 2024 | 2.47% | 1.13% |

| 2023 | 0.69% | 3.76% |

Facts & Key figures

Investment Focus

The Bellevue Diversified Healthcare fund aims to achieve long-term capital growth, is actively managed and invests worldwide in companies with innovative business models that are active in all subsectors of the healthcare sector, such as biotechnology, medical technology, generics, pharma and healthcare services, Show moreShow less

Investment suitability & Risk

Low risk

High risk

General Information

| Investment Manager | Bellevue Asset Management AG |

| Custodian | CACEIS BANK, LUXEMBOURG BRANCH |

| Fund Administrator | CACEIS BANK, LUXEMBOURG BRANCH |

| Auditor | PriceWaterhouseCoopers |

| Launch date | 31.03.2022 |

| Year end closing | 30. Jun |

| NAV Calculation | Daily "Forward Pricing" |

| Cut of time | 15:00 CET |

| Management Fee | 0.90% |

| Subscription Fee (max.) | 5.00% |

| ISIN number | LU2441706509 |

| Valor number | 116533027 |

| Bloomberg | BDHCIUS LX |

| WKN | A3DEAR |

Legal Information

| Legal form | Luxembourg UCITS V SICAV |

| SFDR category | Article 8 |

Key data (31.03.2025, base currency USD)

| Beta | 0.93 |

| Volatility | 12.17 |

| Tracking error | 4.12 |

| Active share | 21.37 |

| Correlation | 0.94 |

| Sharpe ratio | -0.34 |

| Information ratio | -0.74 |

| Jensen's alpha | -3.23 |

| No. of positions | 60 |

Portfolio

Top 10 positions

Market capitalization

Geographic breakdown

Breakdown by sector

Benefits & Risks

Benefits

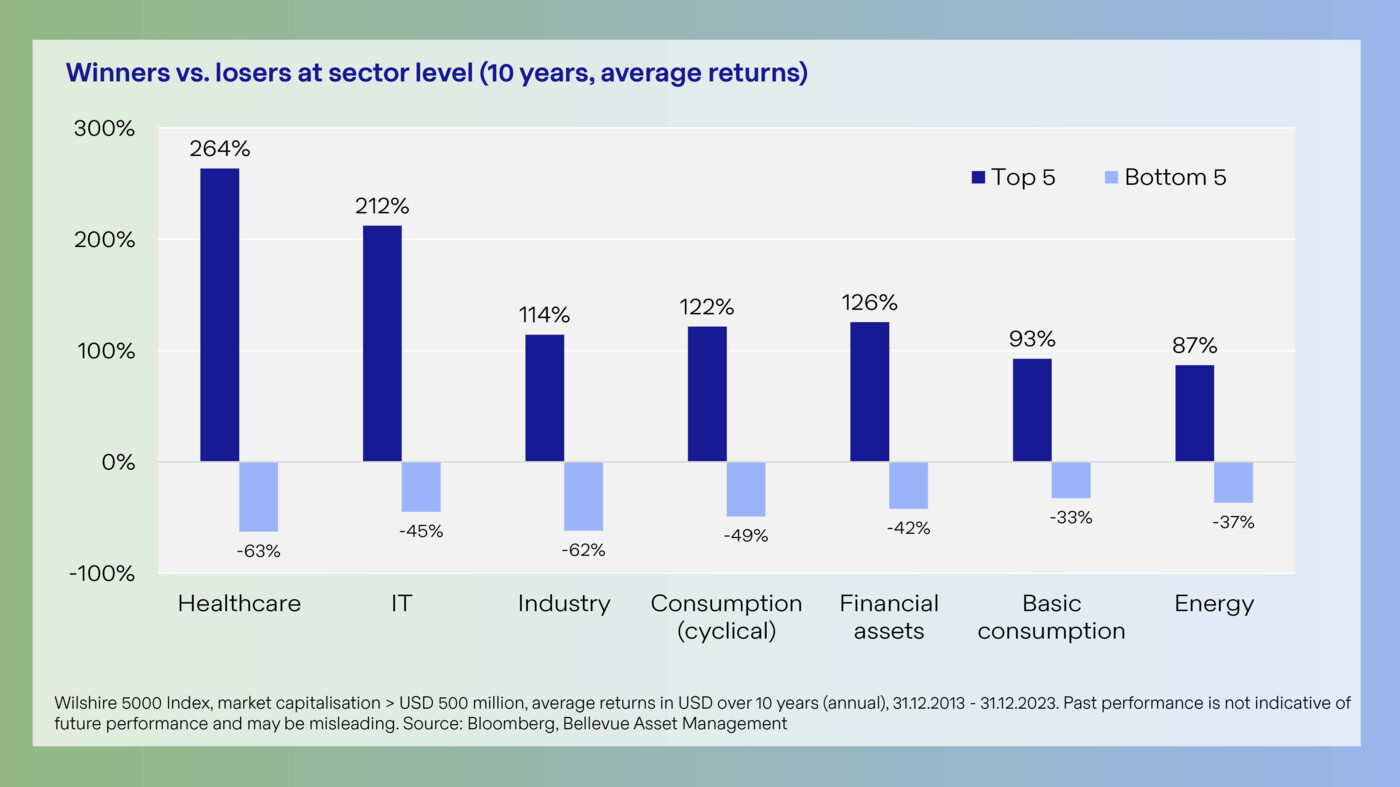

- Profit from the worldwide growth of the healthcare sector, which has clearly outpaced the growth of global GDP during the past ten years.

- Take advantage of the positive characteristics of the healthcare sector and generate alpha through a bottom-up selection process and factor allocation strategies.

- Strategic overweighting of the “structural growth” factor and underweighting of blue-chip pharmaceutical stocks.

- Low earnings risk – above-average earnings growth, even in crisis years, leading to stable portfolio components.

- Bellevue – healthcare pioneer since 1993 and today one of the biggest independent investors in the sector in Europe.

Risks

- The fund actively invests in equities. Equities are subject to strong price fluctuations and so are also exposed to the risk of price losses.

- The fund may invest a proportion of its assets in financial instruments that might under certain circumstances have a relatively low level of liquidity, which can in turn affect the fund’s liquidity.

- The fund invests in foreign currencies, which means a corresponding degree of currency risk against the reference currency.

- Investing in emerging markets entails the additional risk of political and social instability.

- The fund may engage in derivatives transactions. The increased opportunities gained come with an increased risk of losses.

Review / Outlook

Healthcare (MSCI World Healthcare) outperformed global equities (MSCI World) in March by 213 bps. While the sector declined on an absolute basis (-2.3%), it proved to be a relatively safe haven. We see this as being in line with the sector's fundamentals, such as high margins, innovation, and inelastic demand for its products and services. While the defensive names in the sector remained solid, caution is leaving the more innovative names on the sidelines. Biotech performed poorly in the month (NBI; -6.0%), with further underperformance for the higher-growth smaller companies (XBI Biotech ETF; -8.6%). This subsector has suffered from increased regulatory risk driven by changes in leadership at the FDA.

Healthcare Services (+7.8%) was the best performing healthcare GICs industry, driven by supportive earnings commentary (Elevance Health), and a lack of tariff exposure. Pharmaceuticals (-4.3%) started the month as a safe haven, before tariff concerns accelerated and GLP-1 agonist prescriptions disappointed (Novo Nordisk, -23% in March). We saw several licensing deals, with Roche and AbbVie announcing amylin drug class deals with Zealand pharma (deal size USD 5.3 bn) and Gubra (USD 2.2 bn), respectively. Amylin agonism is a different mode of action from the currently marketed GLP-1 agonist obesity drugs, and could become an important new drug class. Medtech was also weak (-4.4%) in the month, with increasing fear regarding slowing economic activity and tariffs driving down multiples. Cost saving initiatives within the National Institute of Health has created some uncertainty regarding life science tools (-4.5%) earnings, although we see only a minor risk for the diversified names (e.g. Thermo Fisher).

From a geographical point of view, Asian healthcare (+1.2%) performed best in March, followed by emerging markets (+1.1%). US (-1.8%) and particularly European (-4.5%) healthcare were disappointing in the month, with the difference being the strength of services in the US and the aforementioned weakness in Novo Nordisk shares.

Bellevue Diversified Healthcare Fund (I-shares: -3.4%, in USD) underperformed its healthcare index benchmark by 107 bps, largely due to a tilt towards innovative companies. Within the fund, we saw a strong performance from several healthcare service names. We also saw good performances from US biotech company Alnylam (+9.4%) following the FDA approval of Amvuttra in cardiomyopathy, and Japanese pharma Otsuka (+6.7% in USD) due to progress with sibeprenlimab in nephropathy.

Healthcare utilization remains strong, therefore the recent sell-off in medtech looks overdone. In terms of biopharma, we point to innovation, for example at the recent American College of Cardiology conference doctors expressed an high interest in treating high Lp(a) levels, which is an independent risk factor for cardiovascular disease. Treatments are coming, and we see this new drug class as holding large sales potential. We remain focused on high-conviction names from a bottom-up perspective, and see a broad exposure to subsectors, style and geography as appropriate from an risk perspective.

Documents

Show moreShow less

ESG

These insights might interest you

I am happy to answer any questions you may have:

Senior Sales Germany

Alexander Jostes