Disruptive technologies are changing an entire industry

The biotech industry is increasingly applying next-generation therapeutic approaches to develop drugs for diseases and conditions with larger populations of patients. The sales potential of these therapeutics is large as well.

From the standpoint of both drug developers and the investment community, the successful development of COVID-19 vaccines and treatments clearly dominated the biotech industry’s innovative power and achievements during the past two years. This “wow” effect is now receding. At the same time, financial markets are shifting their attention to chronic and severe diseases with high prevalence rates. Important advances in biomedical technology that have so far been used to develop treatments for orphan diseases are now being applied more frequently in clinical trials to treat diseases affecting large numbers of people.

The biotech industry will benefit from this because it has pioneered a range of new therapeutic approaches. A large number of biotech companies that had previously been focused on rare diseases have begun to widen the scope of their R&D projects to include diseases with larger patient numbers. Next-generation technologies with huge disruptive potential are being applied here. More and more product candidates not only address indications with high unmet medical needs that have so far been difficult to treat, they also hold out the promise of a complete cure. Several of our portfolio companies will present groundbreaking clinical study results this year.

Moderna’s new vaccines soon ready

This year's headline events for Moderna, a core position in BB Biotech’s portfolio, will likely be the trial readouts for its Omicron-specific booster vaccine and mRNA-1010 flu vaccine. Its next-generation mRNA vaccines are expected to be superior to conventional flu vaccines in terms of efficacy and efficiency because they include other antigens and virus strains besides the typical four vaccine virus components selected annually by the WHO. If efforts to launch a combination vaccine against influenza and coronavirus are successful, the world market for flu vaccines, which currently has an annual volume of about 500 million doses, would grow significantly, and perhaps even double in size. Combination vaccines could appeal to people who are skeptical of repeated single-dose vaccinations. The relatively short development timelines and good tolerability profiles of mRNA vaccines would make today's leaders in this field – Moderna, Biontech and Pfizer – the big winners of such a breakthrough. Industry experts estimate that the price of combination vaccines could be set at up to USD 60 per dose, which gives an indication of the tremendous sales potential.

Applying mRNA technology to develop flu treatments is only one steppingstone in Moderna's long-term road map. Moderna is currently pursuing three key Phase III trials. In addition to its flu vaccine program, it is working on a vaccine for RSV, a virus that can cause severe respiratory infections in infants and young children, and a vaccine for cytomegalovirus (CMV). Currently, there are no treatment options for this herpes virus, which can cause hearing loss and other defects or developmental disabilities in babies.

Genome editing – blockbuster technology

Genome editing, a technology that promises to permanently cure genetic diseases, is on the verge of a major commercial breakthrough. This technology is used to cut out, repair or replace defective fragments of human DNA identified as genetic triggers of disease. Crispr Therapeutics has partnered with Vertex Pharma in developing treatments for beta thalassemia and sickle cell disease. Current treatments for these genetic disorders of red blood cells, which cause serious, even life-threatening complications, are inadequate.

Due to a specific genetic predisposition, the severe form of sickle cell anemia is dominant in the United States, affecting some 50 000 people. Beta thalassemia, also referred to as Mediterranean anemia, is more prevalent in southern Europe, whereas the number of people in the United States who have the severe form of this disease is about 1000. Genome editing is designed to provide a permanent cure following a single treatment. Regulatory approval of the first therapy based on this technology would revolutionize the treatment of this disease. A company offering such a one-time gene-therapy treatment would have considerable pricing power. Crispr and Vertex Pharma will be the first to announce top-line data from a pivotal trial and to submit a marketing authorization application. If their product does enter the market in 2023 as expected, it is forecast to generate annual peak sales in the billions.

Genetic engineering methods for drug development have produced RNA-based therapeutics such as siRNA and ASO (antisense oligonucleotide) which have recently received regulatory approval in niche indications. Our portfolio company Alnylam is a leader in siRNA-based medicines and should announce clinical results for its already approved Onpattro product by mid-year. If successful, the drug’s current targeted population of an estimated 50 000 individuals with ATTR amyloidosis and polyneuropathy would increase by as much as 300 000 through the inclusion of individuals with ATTR cardiomyopathy. ATTR is a rare disorder that occurs when a certain amyloid protein cannot be broken down, resulting in the buildup of an abnormal protein in various organs and tissues in the body.

Using artificial intelligence to build new platforms

Rational drug design is a novel approach that uses artificial intelligence (AI) and machine learning to analyze the molecular motions of protein molecules and better understand disease processes. Portfolio company Relay Therapeutics has three cancer drugs in clinical Phase I studies targeting pathogenic proteins that were previously not viable target molecules for therapeutic purposes. Black Diamond Therapeutics, another company in BB Biotech’s portfolio, uses machine-learning tools to develop novel precision oncology therapies that are designed to work across a number of tumor types.

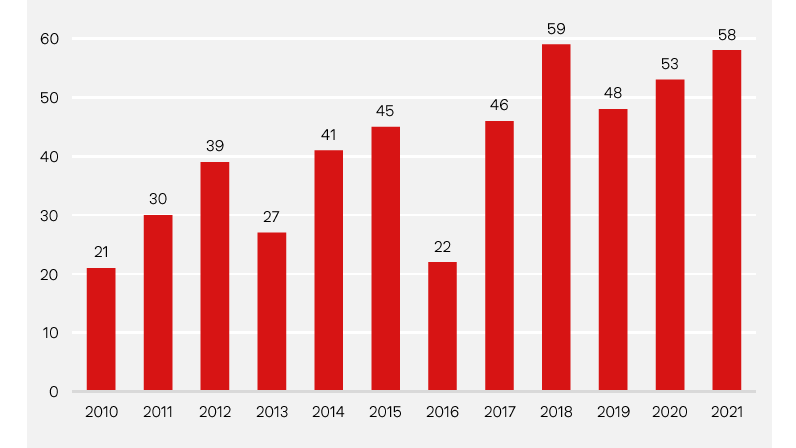

Number of FDA approvals

Thanks to its pioneering role in advancing numerous disruptive technologies, the biotechnology industry could soon be attracting greater investor attention. Annual new drug approvals send a clear message. At the beginning of this century, the average annual number of new drugs approved in the US, the world's largest drug market, was 20. In 2021, this number stood at 58. Meanwhile, from a purely quantitative perspective, the total number of clinical trials and the number of patients enrolled in these trials are now both significantly higher than they were before the pandemic. The importance of biopharmaceutical drugs will continue to grow in the future. It is estimated that biotech products will account for about 40% of all sales generated by prescription and over-the-counter drugs in 2026. These are all compelling arguments that market-moving news from the biotech sector can and will propel biotech stocks higher during the coming years.