The driving forces that will define healthcare for investors in 2025

Mergers and acquisitions are poised to become a defining force in the healthcare sector in 2025. With strong demand, ample capital availability, a stabilizing interest rate environment, and regulatory tailwinds, conditions are ripe for a surge in deal-making. M&A activity acts as a money-multiplier effect within the sector, unlocking capital from the balance sheets of large companies and channeling it into smaller innovators. The year has already started on a strong note, with Johnson & Johnson’s proposed USD 15 bn acquisition of Intra-Cellular in January, reinforcing the momentum for biotech deal-making in 2025.

M&A set to reshape the biopharma industry amid USD 1.3 tn capital surge

Within biopharma, approximately USD 250 bn* in branded sales are at risk over the next five years. These lost sales need to be replaced, with all major players identifying M&A as tool to meet this demand. Indeed, one-third** of the top-25 biopharma annual sales in 2023 were derived from prior M&A, underscoring the sector’s reliance on deal-making. Bringing in new programs and leveraging established sales and marketing platforms, can drive value in large biopharma. With approximately USD 1.3 tn in potential capital available for M&A, companies have ample resources to execute acquisitions, supported by strong balance sheets and the ability to raise debt**. Global interest rates have declined and are now stabilizing, providing a better environment for pricing innovation. Finally, we see a supportive regulatory environment under a new Trump administration Federal Trade Commission (FTC). We see M&A activity as important for driving biotech valuations.

Strong M&A momentum also in medtech

In medtech space, there were 48 M&A deals totaling USD 21 bn in 2024. The largest of these were the purchase of Shockwave by Johnson & Johnson (USD 12 bn), the sale of Edwards Lifescience's Critical Care business to Beckton Dickinson (USD 4.2 bn) and the acquisition of Axonics by Boston Scientific (USD 3.3 bn). Shockwave and Axonics are typical examples of large cap medtech companies acquiring innovative, faster-growing companies to accelerate sales growth and leverage their sales force.

We see the potential for an increase in M&A in the medtech sector in 2025 supported by a more favorable regulatory environment and normalized end-market growth rates. The most active strategic buyers in 2024 were Boston Scientific and Edwards Lifesciences, each with four acquisitions, while Johnson & Johnson, Zimmer Biomet and Stryker completed two deals each.

The momentum has continued into 2025 with Stryker acquiring Inari Medical (USD 4.6 bn), Zimmer Biomet buying Paragon 28 (USD 1.2 bn) and Boston Scientific acquiring Bolt Medical (USD 600 mn). All of these companies are likely to remain active throughout the year. In addition, we see Abbott and Medtronic potentially making some acquisitions. There was a trend towards more takeovers of listed companies in 2024 and we expect this trend to continue going forward.

Innovations shaping 2025: Oral obesity drugs, non-opioid pain therapy, and next generation of robotic surgery

We expect oral pill obesity drugs to be a key focus in 2025. Key late-stage clinical trial data from Eli Lilly with orforglipron is expected in Q2 2025, along with US filing for approval of Novo Nordisk's oral semaglutide (oral version of Wegovy). Following behind, Pfizer could enter late-stage trials with oral danuglipron. While these oral treatments may result in lower weight loss compared to injectables, they offer a potentially more convenient mode of delivery, which we see as crucial for long-term maintenance therapy.

Beyond obesity, we will be closely monitoring the launch trajectory of Vertex Pharmaceuticals' newly approved pain drug, Journavx. This is a new novel mechanism of action in moderate-to-severe acute pain management, which we see as particularly important given the addictive qualities of the current stand-of-care opioids.

In medtech, the approval and subsequent launch of relevant new products will continue to support sales growth, driven by a sustained, above-average volume of surgical procedures compared to the pre-pandemic period, fueled by an aging population with improved access to healthcare.

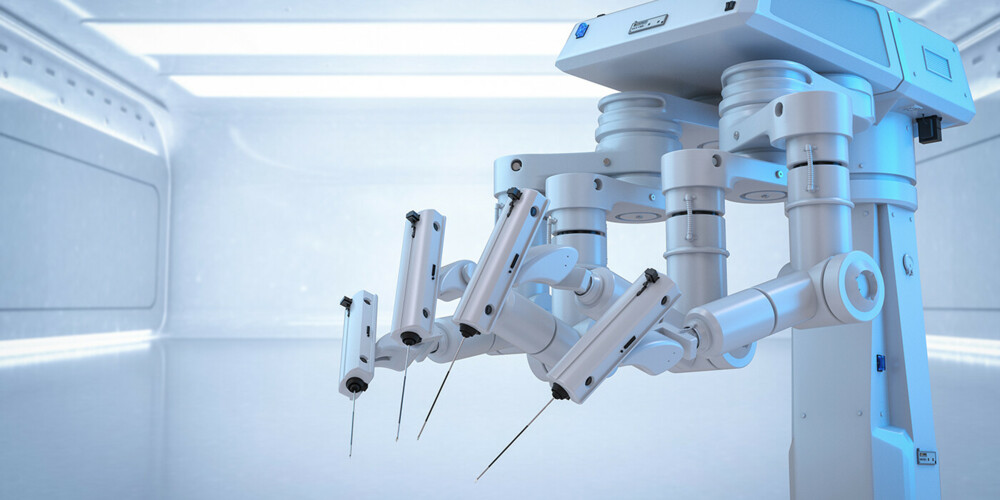

The most influential new product cycle currently underway in 2025 is the full launch of da Vinci 5 robotic-assisted surgery system by Intuitive Surgical, followed by further strong growth of Boston Scientific's Farapulse in pulsed field ablation (PFA) for the treatment of atrial fibrillation to avoid diseases like stroke. In diabetes, Abbott is launching its wearable continuous glucose monitoring sensors Lingo, Libre Rio and Libre 3 plus, and Dexcom is commercializing G7 and Stelo for various patient groups.

In structural heart, Boston Scientific continues to generate momentum with the Watchman FLX Pro, a device for closing the left atrial appendage. Key new products being launched include Edward Lifescience's Evoque for tricuspid valve replacement and Abbott's TriClip system for tricuspid valve repair. Edwards’ Pascal Precision and Abbot's MitraClip both commercialize their mitral valve repair system. Edwards will launch the first commercial mitral valve replacement system Sapien M3 in Europe by mid-2025, with approval in the US expected in 2026. The clinical data for Sapien M3 will be presented at the TCT (Transcatheter Cardiovascular Therapeutics) conference in October.

Given the strong M&A momentum, notable medical innovations, and a favorable regulatory and economic backdrop, 2025 presents an attractive environment for healthcare investments. Investors can capitalize on these trends through actively managed, diversified portfolios, aligned with the sector’s key growth drivers.

*Evaluate, “The Patent Winter is Coming”, 25. Mai 2022

**EY M&A Firepower report, Januar 2025