Explained in 90 seconds

Healthcare systems will benefit from the huge pools of data that have been built up over decades

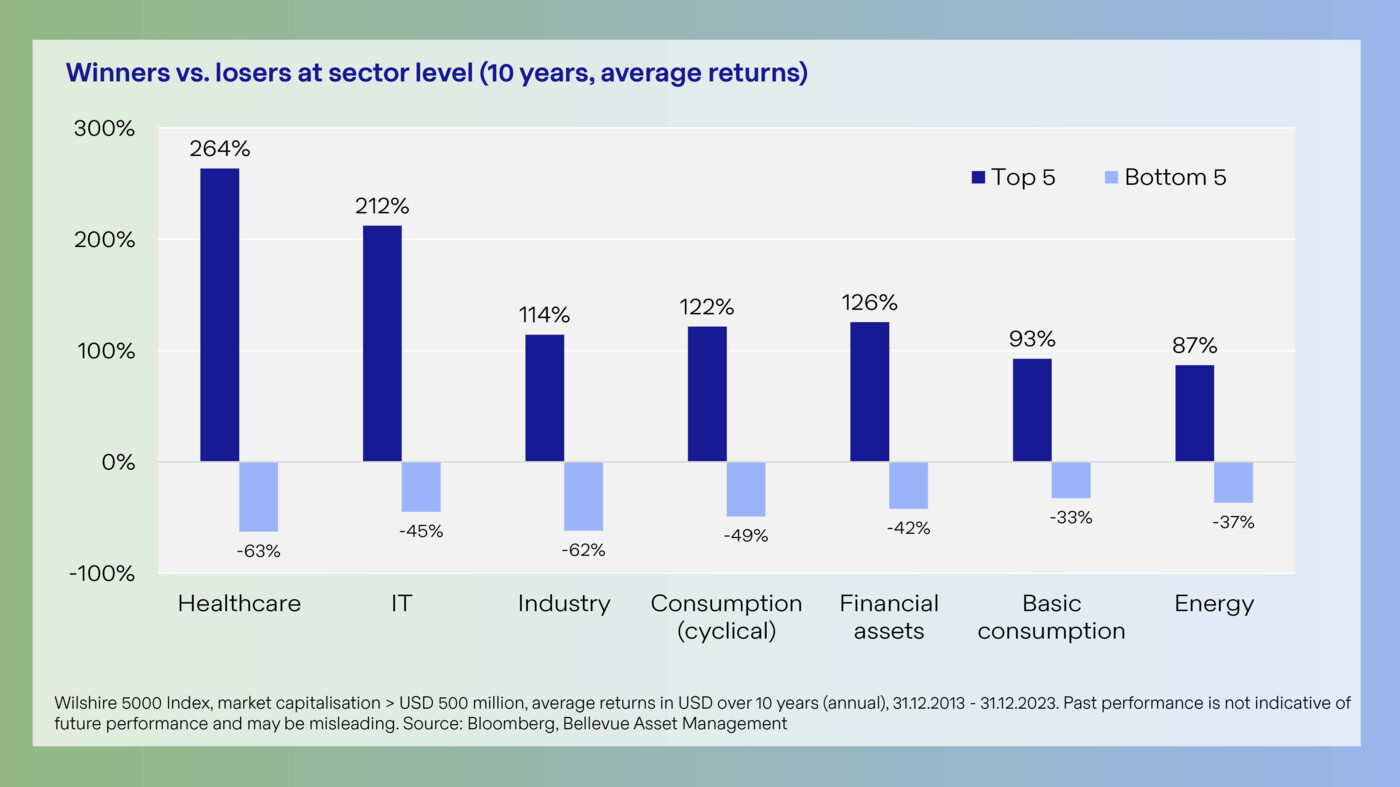

GenAI will be a relevant driver of shareholder value

Sweet spot: Well-capitalized companies with strong AI capabilities

Indexed performance (as at: 06.02.2026)

NAV: EUR 141.20 (09.02.2026)

Rolling performance (06.02.2026)

| I2-EUR | Benchmark | |

| 08.02.2025 - 08.02.2026 | -4.71% | -3.22% |

| 08.02.2024 - 08.02.2025 | 8.66% | 7.73% |

Annualized performance (06.02.2026)

| I2-EUR | Benchmark | |

| 1 year | -4.71% | -3.22% |

| Since Inception p.a. | 6.14% | 6.30% |

Cumulative performance (06.02.2026)

| I2-EUR | Benchmark | |

| 1M | -2.85% | -1.57% |

| YTD | 0.27% | 1.62% |

| 1 year | -4.71% | -3.22% |

| Since Inception | 13.96% | 14.35% |

Annual performance

| I2-EUR | Benchmark | |

| 2025 | 1.20% | 1.26% |

| 2024 | 9.74% | 8.12% |

Facts & Key figures

Investment Focus

The fund’s aim is to achieve capital growth in the long term. The Bellevue AI Health Fund is a global equity fund with an actively managed portfolio of 50 to 70 stocks, mostly from the healthcare sector, rounded out with a small number of tech companies that have considerable exposure to the healthcare industry. Show moreShow less

Investment suitability & Risk

Low risk

High risk

General Information

| Investment Manager | Bellevue Asset Management AG |

| Custodian | CACEIS BANK, LUXEMBOURG BRANCH |

| Fund Administrator | CACEIS BANK, LUXEMBOURG BRANCH |

| Auditor | PriceWaterhouseCoopers |

| Launch date | 30.11.2023 |

| Year end closing | 30. Jun |

| NAV Calculation | Daily "Forward Pricing" |

| Cut of time | 15:00 CET |

| Management Fee | 0.80% |

| Subscription Fee (max.) | 5.00% |

| ISIN number | LU2721086689 |

| Valor number | 130852212 |

| Bloomberg | BAIHI2E LX |

| WKN | A3E1ZY |

Legal Information

| Legal form | Luxembourg UCITS V SICAV |

| SFDR category | Article 8 |

Key data (31.01.2026, base currency USD)

| Beta | 0.93 |

| Volatility | 14.74 |

| Tracking error | 5.26 |

| Active share | 22.23 |

| Correlation | 0.94 |

| Sharpe ratio | 0.28 |

| Information ratio | -0.40 |

| Jensen's alpha | -1.90 |

| No. of positions | 71 |

Portfolio

Top 10 positions

Geographic breakdown

Benefits & Risks

Benefits

- GenAI is speeding up the process of digitization and automation across the healthcare system.

- GenAI can enhance patient care, simplify processes and procedures, and lead to better decisions.

- Companies that use or provide GenAI tools for healthcare-relevant purposes will gain a sustainable competitive advantage.

- Shareholder value creation will largely be determined by a company’s AI strategy and its execution.

- Bellevue – a pioneer in healthcare investing since 1993 and now one of the largest independent investors in the healthcare space in Europe.

Risks

- The fund actively invests in equities. Stocks are subject to price fluctuations, so there is a risk of falling prices.

- The investments the fund makes may be denominated in foreign currency, which can entail a foreign-exchange risk relative to the fund's base currency.

- The fund may invest some of its assets in financial instruments that may have relatively low levels of liquidity under certain circumstances, which may then affect the liquidity of the fund’s own shares.

- There are additional risks in the form of political and social unrest when investing in emerging markets.

- The fund may use derivatives. Derivatives offer greater upside potential yet also carry greater downside risk.

Review / Outlook

US labor market data released in December pointed to a slowdown, while inflation in November came in below expectations. Against this backdrop, it didn’t come as a surprise that the Fed cut its policy rate by 25 bps to a target range of 3.5-–3.75%. The cautious outlook regarding further rate moves, however, was unexpected. The MSCI World and the S&P 500 gained 0.8% and 0.1% in December, while the Nasdaq 100 declined by 0.7%. Following strong performance in November, the healthcare sector fell by 0.8%. Pharma was the strongest contributor, supported by further industry agreements with the US government. The Bellevue AI Health Fund declined by 0.6% but outperformed its benchmark.

BioPharma (55.6% weighting at the end of the month) contributed +0.3% to absolute performance but slightly detracted from relative performance by -0.2%. The strongest contributors were Roche (+8.4%), Novartis (+6.5%) and Novo Nordisk (+4.0%), while Daiichi Sankyo (-13.4%), Alnylam (-11.9%) and Amgen (-5.3%) weighed on performance. In December, nine pharmaceutical companies, including Roche and Novartis, agreed in a further round of industry negotiations with the US government to lower prices for certain government programs and patients under the most-favored-nation pricing model. Daiichi Sankyo withdrew its FDA approval application for Dato-DXd in non-squamous non-–small cell lung cancer following the results of the TROPION-Lung01 study. As a result, market expectations for Dato-DXd declined significantly.

The medtech segment (27.7%) contributed +0.1% to absolute performance and +1.0% to relative performance. Medline (+44.8%), Dexcom (+4.6%) and Danaher (+1.1%) delivered the strongest positive contributions, while EssilorLuxottica (-11.6%), Medtronic (-8.1%) and Boston Scientific (-6.1%) detracted. We successfully participated in the Medline IPO, as the vertically integrated manufacturer and distributor of medical products benefits from high recurring demand and offers attractive growth and margin potential. Efficiency and scalability are further enhanced through robotics in logistics and AI-supported supply chain management. The announcement of an earlier-than-expected launch of Google’s smart glasses model put significant pressure on EssilorLuxottica’s share price.

Healthcare services providers (10.0%) detracted from absolute and relative performance by -0.6% and -0.4%, respectively. Elevance (+4.2%) and UnitedHealth (+0.8%) contributed positively, while BillionToOne (-37.1%), McKesson and Omada weighed on performance. Elevance benefited, among other factors, from positive comments by CVS Health’s management at its investor day regarding developments in commercial health insurance. Following the very successful IPO of BillionToOne in November, during which the share price more than doubled, investors took profits.

The technology segment (3.8%), which includes companies from healthcare and information technology, detracted from both absolute and relative performance by -0.1%. Nvidia (+5.4%) and Qualcomm (+2.3%) contributed positively, supported by confident management commentary at investor conferences. Waystar (-11.3%) and Veeva Systems (-7.1%) weighed on performance. Waystar shares came under pressure after management pointed to slowing growth and seasonal headwinds in patient payment volumes in December.

All performance data in USD / B shares.

The rapid development of generative artificial intelligence (GenAI) is ushering in an unprecedented technological transformation, ranking alongside milestones such as the internet, cloud computing and the smartphone. This development is creating substantial opportunities for companies and investors, particularly in the healthcare sector. Various studies conclude that healthcare is among the sectors set to benefit most from the application of GenAI. This is primarily due to its significant efficiency potential, the vast availability of data and the substantial financial resources within healthcare systems.

We are already seeing faster drug development with higher probabilities of success, improved diagnostic and treatment approaches delivering better clinical outcomes, and GenAI supporting healthcare professionals in making better-informed decisions. We focus on healthcare companies that use GenAI as a core element of their business strategy and allocate substantial resources to this technology, as this can generate sustainable competitive advantages and drive above-average value creation. Technology risk is more manageable in healthcare, given the sector’s highly regulated environment.

Documents

Show moreShow less